how to file taxes for coinbase

You can generate your gains losses and income tax reports from your Coinbase investing activity by connecting your account with CoinLedger. Import your transaction history directly into CoinLedger by mapping the.

Criminals Are Putting Old Tax Returns Up For Sale On The Dark Web Tax Forms Tax Season Income Tax Return

You should enter 0 for what you paid and the fair market value at the time of the receiving it for example.

. Ad Dont Know How To Start Filing Your Taxes. This entire video will walk you through what you generally need to do to file your crypto taxes correctly. How to determine your gains on coinbase and or Gemini.

The crypto exchange company said in a blog post that a new section in its app and website. You also have to complete transactions in cryptocurrency. Youll receive the 1099-MISC form from Coinbase if you are a US.

If you use Coinbase you can sign in and download your gainloss report using Coinbase Taxes for your records or upload it right into TurboTax whenever youre ready to file. Click the Generate report button. Select the relevant cryptocurrency.

In order to receive Form 1099 you have to be an account-holder on Coinbase in the US or US tax-compliant areas. ⁵Coinbase doesnt provide tax advice. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history.

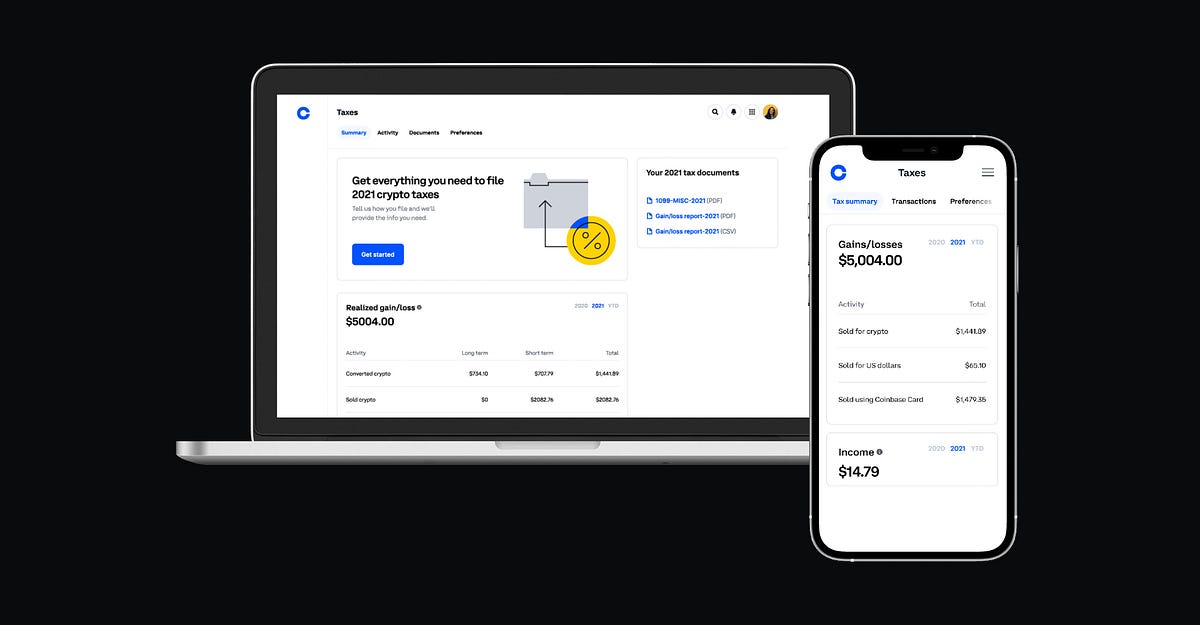

Coinbase wants to help customers file cryptocurrency taxes for the 2021 tax year. Ad Home of the Free Federal Tax Return. Form 1099 reports your third-party transactions to the IRS.

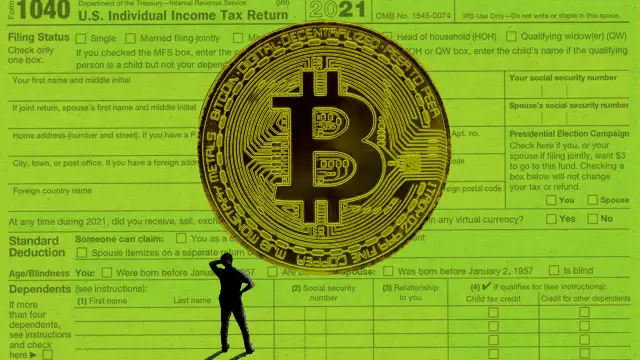

One to the taxpayer and one to the IRS. The gain from selling off Bitcoins is capital gain absent some rather unique facts and whether it is long or short term depends on the holding period. The exchange sends two copies of Form 1099-MISC.

This video really focuses on how crypto taxes work on coinbase but the. Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. You received 1 EOS which at the time of the event was worth 65.

To calculate your gainslosses for the. Its the form used for crypto exchanges because it doesnt simply detail profits it lists the transactions and the. All you need to do with a crypto tax app is add your Coinbase Pro API keys or upload your Coinbase Pro CSV files and let your crypto tax calculator do the rest.

E-File Directly to the IRS. Take how much you paid for the currency and subtract that from how much it was worth when. Yes while Coinbase doesnt issue 1099-Ks they do issue the 1099-MISC form and report it to the IRS.

Thus if you have received a 1099-MISC from Coinbase so has the IRSand theyll be. There are a couple of ways you can do this. Upload a CSV file to Coinpanda There should be a button for exporting your entire wallet history in Coinbase.

Premium Federal Tax Return Software. Information here is provided to help you understand your taxes but should be reviewed before you use it to file your taxes. Answer 1 of 3.

If you made 600 in crypto Coinbase is required to use Form 1099-MISC to report your transactions to the IRS as miscellaneous income Even if you make less than 600 via. On the top tabs select Wages Income Scroll down to Less Common Income section and select Start or. Leave the default settings All time All assets All transactions or.

E-File Directly to the IRS. Paste your xPub address or public addresses. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received.

Ad Home of the Free Federal Tax Return. With your return open select Federal from the left side navigation. If you purchased the.

Premium Federal Tax Return Software. Go to the Reports page by clicking the user icon in the top header and click Reports. Connect With An Expert For Unlimited Advice.

Look for a history export option in Coinbase Wallet that will create a CSV file containing all your transaction data simply import it into Koinly and. Coinbase Tax Reporting.

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase Insta A Sus Usuarios A Pagar Impuestos Sobre Ganancias En Bitcoin Filing Taxes Income Tax Tax Brackets

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Pricing Of Cryptocurrency Tax Software Beartax Tax Software Cryptocurrency Accounting Firms

Crypto Taxes Ways To File Youtube

Coinbase Users Will Be Able To File Tax Reports By The Coin Tracker Service Filing Taxes Cryptocurrency Bitcoin Account

Pin By Piao On 品牌插画 Website Illustration Illustration Map

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Learn How To Set Up A Crypto Wallet Youtube In 2022 Learning Wallet Setup

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

Crypto Taxes How To Calculate What You Owe To The Irs Money

Coinbase Tax Documents To File Your Coinbase Taxes Zenledger

How To File Taxes If You Bought Crypto In 2021 Time

How To Get Coinbase Tax Documents Download Crypto Taxes Youtube

Get Your Tax Refund Into Coinbase When You File With Turbotax By Coinbase The Coinbase Blog

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase